The capabilities of Artificial Intelligence are being leveraged in every business domain. The inclusion of AI in any industry is proving its Midas touch. The insurance industry has seen an upsurge of clients implying that it needs to get even more resilient. So, let us integrate AI and the Insurance sector to get a glimpse of all that can be achieved.

Streamlining the Flow of Data across Departments

There are several departments in an organization. Each having its own set of data and records. Though they work independently, yet there is considerable inter-dependence between them.

This can be observed from the fact that any department may need the data of another department. Moreover, data is usually humongous in volume. With data piled up all around, it becomes important to organize it. A technologically-sound environment can be created for data segregation and categorization through AI. It also streamlines the sharing of data – across departments with almost zero latency. This helps task management and improves the quality of Management Information System (MIS).

More Competitive Pricing Policy

Before pricing your own insurance products, the pricing policies of your competitors need to be considered. It is neither feasible nor advisable to compare all prices manually.

AI can compare prices of similar policies across several competitors. Search engines compare insurance policies on parameters like price, claim to settlement ratio et al. Your product rankings improve if you offer more features at a lower rate. AI can help in this too!

Automated Claim Settlement

Claim settlement is laborious and time-consuming work. AI-enabled claim settlement offers a contactless settlement, key in the present pandemic situation. Reduced human interference is vital for safeguarding the lives of people.

AI can register the claim, monitor the damage or the losses incurred and log all the details into the system. Scanned photos and videos via AI systems can give a clear and precise measure of the losses, in no time. Fraud-detection algorithms enable authentication of policy claims before settling them. The entire claim can be settled, timely & judiciously, benefitting both the customer & insurer. The process of automated claim settlement is quicker and safer in all aspects.

Customer’s Preferred Choice

In a recent survey, it was found that customers prefer AI-based systems to manual systems. This can be attributed to its robust communicative capabilities and automated claim settlement.

Ultimately, it is customer satisfaction which makes or breaks the deal. The popularity of AI-based systems has necessitated an early adoption of this technology. Consistency is the key to any successful business. This consistency offered via AI-based systems is unparalleled and unbeatable.

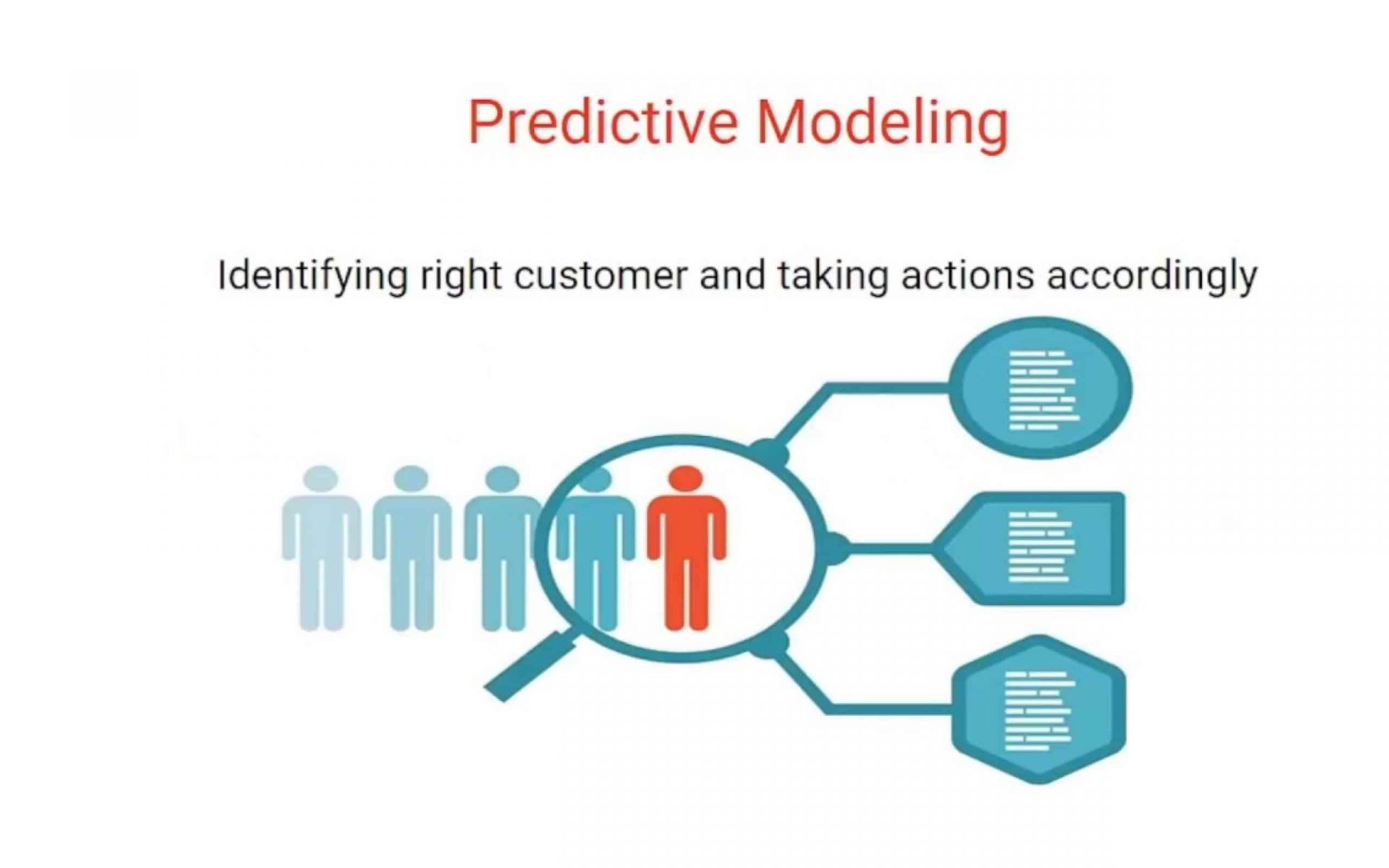

Predictive Modelling

One of the key use cases of AI is to predict the future outcome based on certain factors. The ability to interpret things, in advance, gives insurers the freedom to plan their strategy and improve their service.

- Predictive Modelling powers recommendation engines. Recommendation engines can suggest the right policies suitable for that customer. Thus, offering the customers a hyper-personalized and hassle-free experience. The predictions can be used to serve the customer with his exact need. For companies, this enables a better estimation of their resource utilization. So, based on a customer’s past medical records, lifestyle, etc. the AI system can predict the likelihood of a customer redeeming his claim amount. Enabling companies to get a better understanding of their profits and claims.

Who would not desire a life of comfort under the umbrella of a good Insurance policy? We guess, everyone would! So, what are you waiting for? Stay ahead of your competition by integrating your Insurance ecosystem with Babel’s unique AI solutions. Get digitalized, Get ahead!